Digital health at the turn of 2024: Tracking developments along the innovation maturity curve

December 11, 2023 by Irene GoldenConsultingMihir SomaiyaResearchSari KaganoffGeneral Manager, Consulting.

With help from:Adriana Krasniansky Megan Zweig Tom Cassels Claire Egan Doyle

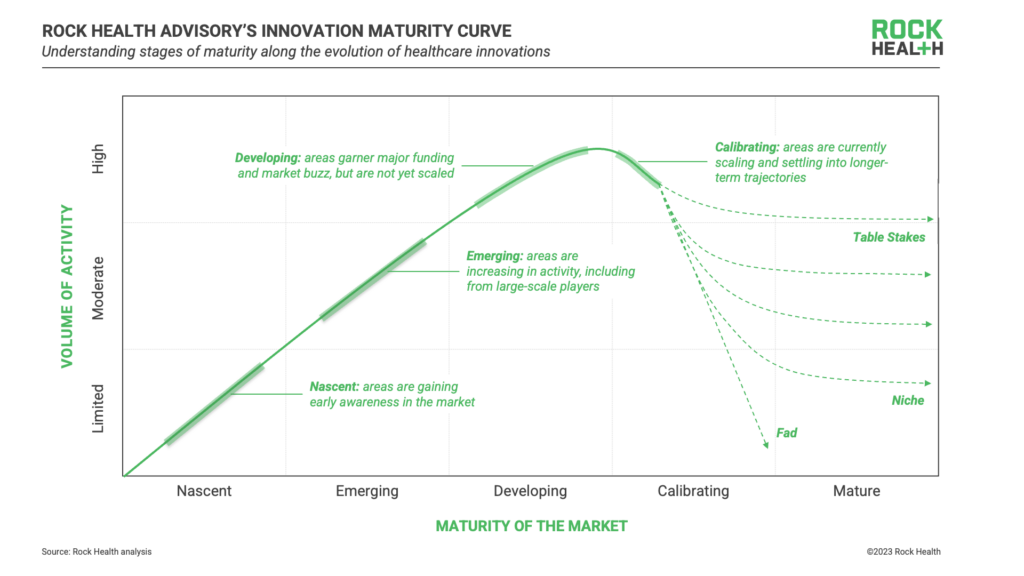

As we look ahead to the end of 2023, reflecting upon the buzzworthy topics from this past year has us wondering—how are the hottest areas in healthcare innovation trending, and what should we be following closely in the year ahead? In true Rock Health Advisory fashion, we used data to plot major developments in digital health along our innovation maturity curve 1 to help strategy and innovation leaders find opportunities to be a first mover or understand where there is competitive pressure to catch up.

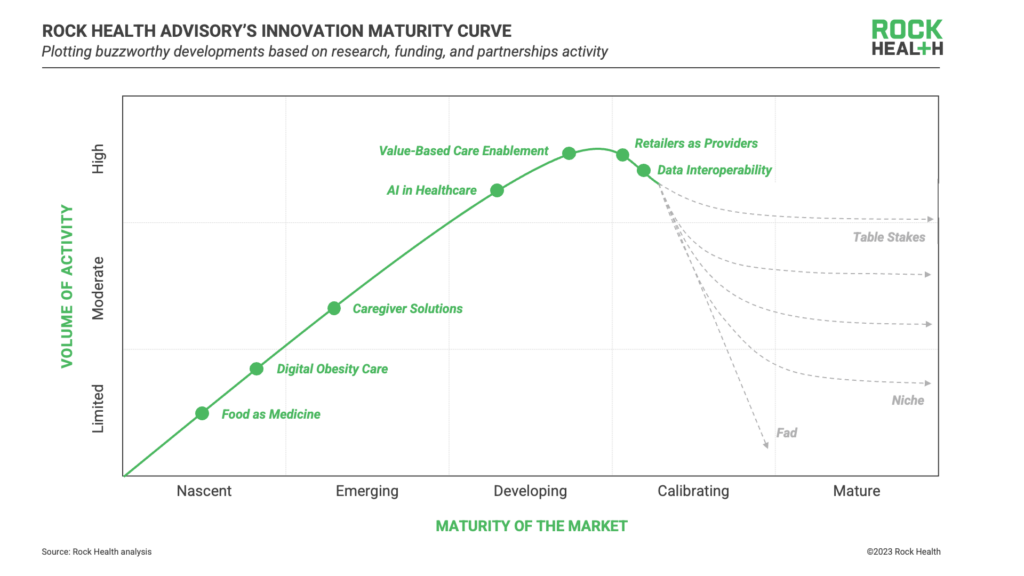

Based on recent conversations across the digital health ecosystem and questions we’re getting from clients, we selected seven buzzworthy developments to analyze: AI in Healthcare, Caregiver Solutions, Data Interoperability, Digital Obesity Care, Food as Medicine, Retailers as Providers, and Value-Based Care Enablement.

Our innovation maturity curve analysis scores and ranks developments by their relative maturity, based on three measurable indicators2:

- Research publication volume measures early potential and industry interest—we assessed the annual volume and two-year growth of PubMed mentions across developments. A spike in recent activity and/or growth translated to more nascent activity on the curve.

- Venture funding tracks investor excitement, with high funding volume aligned to more mature developments and high funding growth aligned to more nascent developments (slower funding growth indicates stabilization), as measured by the Rock Health Venture Funding Database.

- Partnership activity is a proxy for commercial traction, with high volume and growth in partnerships aligned to more mature developments. Our partnerships database, which tracks digital health partnerships between enterprises and startups, was used to analyze these measures.

Below, we’ll dive into the placement of each development on the innovation maturity curve (in order of relative maturity) as well as the dynamics to keep an eye on in 2024.

Food as medicine

Innovation maturity score: Nascent

In recent years, digitally-delivered nutritional recommendations and interventions have expanded from being “niche” support services for a narrow set of use cases (e.g., type 2 diabetes) and are now being used to prevent and treat many conditions ranging from cancer to mental health disorders. In 2023, we’ve seen growing research activity, policy shifts, expanding reimbursements, and budding innovation in food as medicine, headlined by digital players including Season Health, ModifyHealth, and Instacart, among others. In fact, the NIH previously earmarked an estimated $1.9B annually to advance nutritional research efforts. According to our PubMed search, food-oriented medical research has appeared in 1900+ publications so far in 2023, the highest among our analyzed developments.

What to keep an eye on: As legislation and reimbursement pathways continue to expand in 2024, retailers (e.g., Instacart, Kroger, and Giant) will likely double down, further investing in medical nutrition innovations to bolster their other retail healthcare offerings. At the same time, Medicare Advantage (MA) plans will continue to emerge as early adopters, using food as medicine programs as wraparound services to support superior health outcomes (with other forward-thinking payers to follow suit). Innovative providers and startups delivering care in applicable therapeutic areas, including in the rapidly expanding obesity care market, will also be able to use food as medicine programs to differentiate their care delivery models, likely through partnership with the growing collection of startups focused on food as medicine.

Digital obesity care

Innovation maturity score: Nascent

While GLP-1s stole the spotlight throughout 2023, weight management-oriented support services (e.g., remote monitoring, lifestyle coaching, mental health support) have also evolved. We’ve seen existing companies create or expand weight loss programs as well as new companies launch to address growing consumer demand. From 2020 to 2022, PubMed mentions of digitally-enabled obesity care grew by nearly 85%, describing a growing body of evidence as research findings are translated into practical care models (capturing $176M in venture funding from Q1 to Q3 2023, mostly from early-stage startups).

What to keep an eye on: Supply chain, cost, and accessibility challenges with GLP-1s will continue to impact their path to market. Especially for high-cost GLP-1 medications, payers, providers, and patients must contend with the feasibility of potentially life-long medication regimens (and their side effects), further highlighting the importance of whole-person obesity care offerings. Payers will likely push for more precise triage and treatment programs, determining who will get priority for medication-based programs, and which interventions will help patients move off of medications in the long term. Drug manufacturers themselves will need to position their therapies within the whole-person care paradigm, including how they integrate with digitally-delivered care. Incoming obesity care models will likely differentiate through increased personalization and ability to address the root cause of disease.

Caregiver solutions

Innovation maturity score: Emerging

Solutions supporting care for aging adults is not a new segment in digital health, but caregiver-specific innovation is—this includes solutions focused on caregivers of aging loved ones, parents (caregivers of children), and caregivers of folks experiencing illness or disability (not to mention the ”sandwich generation”). Since 2021, the estimated economic value of family and unpaid caregiving in the U.S. has surpassed $600B. In parallel, the Great Resignation pushed caregivers out of the workforce, drawing attention to rising caregiver burden and its impact on employer costs. With increasing federal and state-level commitments for family caregivers and 400+ publications involving digital caregiver-oriented interventions in PubMed in 2023 (year-to-date), caregiver solutions are emerging to support unmet needs.

What to keep an eye on: In 2024, we expect that the drivers pushing the caregiver-focused market forward are only going to grow as difficult macroeconomic conditions continue to exacerbate the challenges and negative health impacts faced by caregivers today. Employers will likely join consumers in purchasing solutions which meet these demands, perhaps focused on administrative caregiver solutions (e.g., care navigation, family logistics)—successful B2B2C caregiver solutions will generate evidence proving their ability to lower absenteeism, garner engagement, and support caregiver-employee wellbeing and productivity. Life sciences companies and providers may also consider investing in caregiver-oriented solutions, focusing on clinical areas where there is high caregiver influence or need. We expect to see more startup solutions which support the variety of relevant jobs to be done by caregivers, including delivering care, managing medical logistics, and self-managing the frequent stressors that come with caregiving (e.g., mental health challenges, balancing work, caregiving, and family responsibilities).

AI in healthcare

Innovation maturity score: Developing

Generative AI has taken the world by storm since ChatGPT’s public launch in late 2022, creating a hubbub within AI in healthcare. AI algorithms have loomed large in healthcare innovation for years, supporting jobs such as patient triage, scheduling, medical scribing, and drug discovery. Of the seven developments analyzed in this piece, AI-enabled solutions outpace the rest in 2023 venture funding with nearly $2.8B in funding across 101 deals (through Q3 2023). While startups leveraging AI raised significant capital in 2023, we also tracked high growth in partnerships (second only to value-based care enablement)—a strong indication of commercial traction.

What to keep an eye on: While 2023 has been a big year for AI, there is still room to grow before AI-enabled solutions are embedded at scale in healthcare. The FDA, on the back of a new tranche of approvals through 2022 and 2023, is expected to continue to increase its rate of approvals by more than 30% for AI/ML technologies. For AI builders, questions around algorithm bias based on non-diverse datasets, ethics, and transparency are key to making the leap to clinical use cases. For providers, payers, and life sciences companies alike, solidifying an approach to AI governance and thoroughly assessing the tradeoffs between platform-level integrations (e.g., EMR plugins) and best-in-breed solutions (e.g., applications for specific features) will be central to establishing a successful long-term AI strategy. Finding an ideal portfolio of partners across the growing cohort of startups, big tech companies, and legacy healthcare software developers will be top of mind across 2024.

Value-based care enablement

Innovation maturity score: Developing

While value-based care has been a topic of discussion for decades, it’s easier to write about than it is to adopt at scale. Value-based care enablement companies specialize in making it easier for providers and payers to adopt risk-based business models—enabling them to execute on value-based agreements, monitor outcomes, surface relevant data, assess risk, and engage patients in outcomes-oriented care. Tech-enabled kidney care-focused companies and primary care capitation models have been the talk of 2023, garnering some of the largest investments of the year. With the highest growth in partnerships compared with other analyzed developments, value-based care enablement is gaining commercial traction and moving closer to maturity.

What to keep an eye on: The value-based care enablement landscape in 2024 will largely be dependent on the outcomes (e.g., clinical, engagement, enrollment, utilization) demonstrated by dominant national payers (like UHG and Humana) and managed service organizations. Another factor we’re keeping our eye on in the value-based care space is consolidation: as major provider systems continue to merge, value-based care enablement solutions may also be pushed toward platform-ization to address a range of needs in one solution. Regardless, while providers are likely to expand value-based contracting in clinical areas in which risk-based payment models are easier to adopt (i.e., areas with solidified, attributable care pathways, and semi-predictable spend)—the complexity of developing and executing on these contracts remains a core challenge. Both providers and payers will likely have to lean on enablement-focused startups that can effectively support this complexity in order to take the leap into value-based contracting.

Retailers as providers

Innovation maturity score: Calibrating

Big box retailers have been making moves as healthcare providers for over a decade now—Target began partnering with Kaiser Permanente on in-store clinics back in 2014, and Walmart opened its first clinic in 2019. This year, we’ve seen new entrants like GNC and Costco join the fray as providers or provider partners, and existing players like Walgreens, Amazon, and CVS mature their offerings—though not without some wobbly moments. In addition to the four big ticket acquisitions that dominated headlines in 2023, retailers have increasingly engaged in partnerships with digital health companies to facilitate the delivery of care outside of the brick-and-mortar clinic, signaling that the sector has matured.

What to keep an eye on: While retailers have been historically focused on primary and urgent care, we expect the sector to expand into higher cost clinical areas like chronic disease as retailers embed their care models more deeply into the healthcare system. In 2024, retailers will continue to mature and expand their care models, focusing on reducing the friction during handoffs between retail providers and traditional providers for higher acuity cases, and on meeting demand in the home through omnichannel services. As retailers increasingly invest in robust triage and care navigation solutions, startups and providers may find partnership opportunities amidst the race toward expansion and scaling of highly convenient care.

Data interoperability

Innovation maturity score: Calibrating

Data interoperability has been a longstanding priority in digital health, governed at the national level by landmark legislation like HIPAA and the HITECH act. A major cohort of digital health companies (accounting for more than $630M in funding from Q1 to Q3 2023) are deploying solutions to help stakeholders comply with and take advantage of data interoperability. At the same time, interoperability infrastructure in the U.S. is still under construction, with the ONC recently onboarding the first cohort of Qualified Health Information Networks, an effort in-the-works since TEFCA’s publication in Q1 2022. As data sharing regulations stabilize, large-scale commercial partnerships continue to grow.

What to keep an eye on: Access to clean, reliable, and useful data will be increasingly important as more powerful data analytics tools become available. Interoperability solutions that prioritize accuracy, depth of information, security, and usability will likely differentiate themselves in 2024 as incumbents continue to adopt more advanced data infrastructure. Alongside increased security, aggregation, storage, and connectivity of healthcare data, disruptive interoperability solutions will likely feature built-in analytics and insights capabilities as a value-driver for their customers. Moving forward, payers and providers will have to look inwards—thoroughly evaluating their existing data management strategy and beginning to upgrade their internal data infrastructure (and partnering where needed) to support advanced analytics.

If 2023 was a year of transition as digital health moved into its next era, we expect 2024 to be a period of recalibration and adjustment. Major market developments will continue their trek along the innovation maturity curve, and leaders will need to answer questions like:

- Which capabilities and partnerships do we need in order to keep up with table stakes innovation?

- How can we take advantage of nascent opportunities to be an early mover?

- As we evolve existing businesses and assets, how do we position them for further growth within tough market conditions?

So here’s to another year of progress along digital health’s innovation curve. While it may be a little while before the winter frost thaws (stay tuned for more in our year-end funding piece, coming in January), we’ll keep tracking where digital health’s major developments go next and exploring new ways to help bring these innovations to life. See you on the slopes?

For help answering these questions and to tap into strategic insights and guidance for enterprise companies, reach out to Rock Health Advisory.

Get in touch with the venture team at Rock Health Capital.

Join us in building a more equitable future at RockHealth.org.

And last but not least, stay plugged into the Rock Health community and all things digital health with the Rock Weekly.

Footnotes

- Rock Health Advisory’s innovation maturity curve is inspired by the Gartner Hype Cycle, adapted to account for the many possible maturation pathways that digital health innovations may take (e.g., becoming table stakes/must-have capabilities, niches, fads, or somewhere in between), and the distinct stages of nascency or maturity along the way

- After rank-ordering digital health developments from most mature to most nascent along each indicator, we used the average relative rank to assign each a score and placement along the innovation maturity curve. Growth data across indicators was calculated using full-year data from 2020 to 2022; data through November 13, 2023 was used to measure year-to-date 2023 activity, used for comparison purposes only; PubMed mentions for each development were collected using multiple keyword combinations, averaged to obtain a single measure per year.

- ONC refers to the Office of the National Coordinator for Health Information Technology under the U.S. Department of Health and Human Services; TEFCA refers to the Trusted Exchange Framework and Common Agreement